The incompatibility with the economic realities of the single currency euro zone initiated by the core countries of the European Union with underlying political incentives with a shortsighted and imprudent haste in a manner unexpected from them has once again surfaced with the financial crisis of the Greek Administration of Southern Cyprus (GASC). A single currency without a central bank in the traditional sense, without a common fiscal policy and still unaccomplished common banking regulations and with no exit policy or options, while prone to stumbling even in good times due to the very different economic strengths, characteristics and expectations of the member countries, has hit the ground in times of the global crisis.

It has recently been seen with the Greek recovery package that recovery packages for the weak economies do not usher in the expected results and a lesson has most likely been learned to contemplate new solutions. It transpires that among new practices, the eventuality of exiting from the Euro zone and measures that will put the least burdens on the entire structure are considered. Hence, compared to the example of Greece, in the recovery package for the GASC, it is to be seen that the proposals are more rigid, with harsher conditions. The fact that the GASC is a very small economic entity undoubtedly also plays a role. The gross national product (GNP) of the GASC forms a portion smaller than half percent of the 9.4 trillion Euros of total GNP of the EU. Likewise, the turmoil to be created should it exit the Euro zone will be much more limited compared to Greece.

The other side of the coin is that while the recovery package for such a small economy creates less of a burden on the EU compared to other countries in distress, why the conditions are aggravated is a question that needs to be answered. The European Union endorsing the membership of the GASC by violating its own principles with the prospect of leaving Turkey outside has conveyed the wrong message. Since the end of 2012, approximately seven times the GNP, a total of nearly 90 billion dollars of deposits, have been put in the banks of the GASC. Almost half of these deposits have been received mostly from Russia and non-EU countries such as Armenia and Ukraine. The Russian deposits alone of approximately 25-30 billion dollars are under suspicion of having illegal links. Another justification for the EU’s harsh approach can be seen in not abetting illegal transfers as well as sequestering the needed financial support from these alien deposits.

It is understood that the GASC requires approximately 20 billion dollars for its recovery package, that the EU could provide 13 billion dollars of this amount while it is suggested that the remaining 7.5 billion dollars be provided from the bank deposits with a tax of approximately ten percent. (for deposits less than hundred thousands Euros, this portion has been freed from tax, leaving the bulk of the burden to foreign deposits). As the initial proposal was rejected in the GASC Assembly and the EU insisted on its conditions, the GASC has appealed to Russia with a taint of political blackmail, and has asked for assistance from Russia offering assets of the GASC. Russia, not yet having received its earlier payment of 3.3 billion dollars, was faced with a dilemma and based on the fact that it is bound to lose at least 2.5-3 billion dollars of Russian deposits, as a first reaction has criticized the EU’s harsh stance. On the other hand, having assessed the GASC assets, has not found it economically or politically feasible at this stage.

The EU was also faced with a serious dilemma, on the one side, opening a door to Russia, to gain further influence in eastern Mediterranean with GASC after Syria and furthermore, paving the way to Russia participating in the EU’s domestic problems. Hence, the EU has opted to move on with yet another patch on the punctured tire. GASC on the other hand, may have saved the day with the proposed rescue package at the expense of shooting itself in the foot, giving up on its one major source of revenue and casting in doubt its future welfare.

© 2009-2025 Center for Eurasian Studies (AVİM) All Rights Reserved

EUROPE AND THE EUROPEAN UNION - THE EUROPEAN SEGREGATION

EUROPE AND THE EUROPEAN UNION - THE EUROPEAN SEGREGATION

THE GREEK INDEPENDENCE: MEMORY AND POLITICS, THE US PRESIDENT RUBS SALT TO THE WOUND

THE GREEK INDEPENDENCE: MEMORY AND POLITICS, THE US PRESIDENT RUBS SALT TO THE WOUND

THE POLITICAL GAMBIT OF SERZH SARGSYAN

THE POLITICAL GAMBIT OF SERZH SARGSYAN

LETTER BY ATTORNEY BRUCE FEIN IN THE INTEREST OF HISTORICAL AND LEGAL TRUTH

LETTER BY ATTORNEY BRUCE FEIN IN THE INTEREST OF HISTORICAL AND LEGAL TRUTH

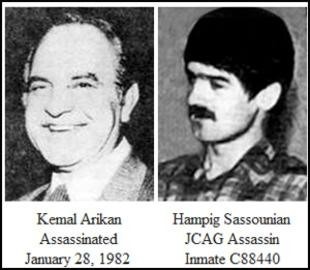

THE PAROLE OF HARRY (HAMPIG) M. SASSOUNIAN, THE PERPETRATOR OF THE MURDER OF TURKEY’S CONSUL GENERAL TO LOS ANGELES KEMAL ARIKAN IN 1982

THE PAROLE OF HARRY (HAMPIG) M. SASSOUNIAN, THE PERPETRATOR OF THE MURDER OF TURKEY’S CONSUL GENERAL TO LOS ANGELES KEMAL ARIKAN IN 1982