We had addressed the difficulties before the European Union for the solution of the Euro crisis in a previous article. The declaration of bankruptcy by the Greek Administration of Southern Cyprus (GASC) has yet again brought to the fore that the crisis within the EU continues. The GASC has declared to EU officials that it urgently needs a bail out assistance of 17 billion Euros and should this assistance not be approved in the meeting of Ministers of Finance of the Euro zone on 21 January and endorsed on February 10, it would fall on terms of bankruptcy. In a number of articles in the press, it is estimated that the GASC is in a much direr situation than Greece.

However, it transpires that the repetition of a mechanism of the bail out assistance provided to Greece to rescue the country from bankruptcy faces serious obstacles to be applied to the GASC this time. Firstly, Germany, which has assumed the major responsibility for the decision on Greece, has now brought forth a precondition in taking a similar initiative to rescue a country from bankruptcy. For such an initiative, it has made it mandatory for a banking supervisory mechanism to be established within the sphere of the Euro zone. It does not look probable that this initiative worked out by the European Central Bank will be completed anytime in February or March.

It is frequently reported in the international press that large amounts of money from Russia and Ukraine are deposited in the banks of the GASC and that those banks do not have a clean record in matters of money laundering and illegal money transfer. It is also indicated in the press that the likelihood of steps of transparency in the operations of the GASC’s banks has created concern in Russia. In this context, President of the GASC Central Bank’s statement that they could also count on the contribution from Russia if the EU decides in principle to provide assistance is interesting. It is estimated that Russia’s contribution could be up to 5 billion Euros. On the other hand, it is not surprising that the EU does not have a warm attitude towards Russian contribution and rather tends to await the report of Pimco, a US consulting agency which is researching the long term health of the GASC banks.

One element in the timing of the GASC’s call for urgent bail out assistance is without doubt the “presidential” election to be held in March. It is clear that domestic policy considerations in the GASC do not echo sympathy in the EU. It could also be seen that the credit provided to the GASC by EU leaders is reaching its limits. For instance, in the recent press conference between the German chancellor and the President of Malta, it is reported that while comparing Malta with the GASC, she has said that both countries are island states and that the similarity ends there. Likewise, it has been further reported that while serious negotiations were taking place on deducting state’s debts accruing from investment in calculating public debt ratios during the December 2012 EU leaders’ summit, the GASC leader’s taking the floor to say that his country was under heavy military expenditure due to Turkey and his proposal to deduct the military expenditures as well was met with sarcasm.

Following the warnings of the German chancellor and the main opposition leaders of the German Parliament, the EU Commissioner’s statement on January 11 that eliminating money laundering of banks and bringing to an end practices of tax evasion need to be addressed by the GASC with regard its call for bail out assistance. Such statements and warnings confirm and bring into light a stain difficult to clean not only for the GASC, but also for the European Union asserting itself to be an economic union.

© 2009-2025 Center for Eurasian Studies (AVİM) All Rights Reserved

AN ASSESSMENT OF 2015 FOR ARMENIA

AN ASSESSMENT OF 2015 FOR ARMENIA

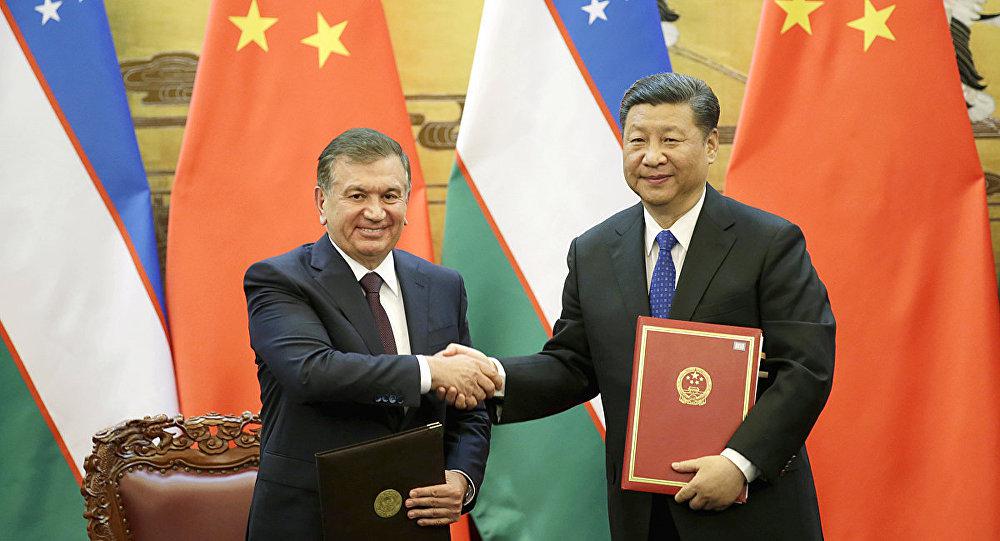

AN EVALUATION OF THE STRATEGIC AGREEMENT BETWEEN CHINA AND UZBEKISTAN

AN EVALUATION OF THE STRATEGIC AGREEMENT BETWEEN CHINA AND UZBEKISTAN

2016 WARSAW SUMMIT AND THE NAGORNO KARABAKH ISSUE

2016 WARSAW SUMMIT AND THE NAGORNO KARABAKH ISSUE

THE POST-WAR LANDMINE ISSUE IN KARABAKH

THE POST-WAR LANDMINE ISSUE IN KARABAKH

DOES THE G7 SUMMIT PROVE THAT THE WEST CAN “BUILD BETTER"?

DOES THE G7 SUMMIT PROVE THAT THE WEST CAN “BUILD BETTER"?