Deniz ÜNVER

Independent Researcher

In the aftermath of the COVID-19 Pandemic, the international community has begun to witness intense change and instability in many regions. The initiator of this change and instability has been Russia’s invasion of Ukraine that began in February 2022. This was followed by intense de-dollarization moves in many parts of the world. Today, there exists many examples of this trend in different regions.

First, China has been making efforts to undermine US dollar hegemony in multiple cases. One example of this case is the recent swap agreement between China and Argentina. The two countries have broadened a currency swap pact that will assist Argentina by preventing the shocks caused by financial policy tightening of US as well as enhancing the country’s industrial level[1]. The presidents of the Central Banks of China and Argentina declared that the swap deal between both institutions has been activated and the use of yuan will be promoted in the market of Argentina[2].

As a matter of fact, China and Argentina had signed the first currency swap deal, which was worth 70 billion yuan and valid for three years, in 2009[3]. In July 2014, the sides signed another currency swap deal worth of 70 billion yuan[4]. Following this, in July 2017, Central Bank of China renewed the swap deal, providing the swap of 70 billion yuan for 175 billion Argentine pesos, with the Central Bank of Argentina[5]. In December 2018, a supplementary currency swap deal, worth of 60 billion dollars, was signed between the Central Banks of two countries[6].

Argentina is not the only country that China has been making swap deals with. Brazil, the largest country in South America, increased its foreign reserves in yuan more than 4 times in 2021[7]. In addition to this, yuan reserves of 4 South and Central American countries (Chile, Brazil, Mexico and Peru) have reached the limit of approximately 30 billion dollars, as stated by Goldman Sachs[8]. Indeed, it is assumed that the de-dollarization moves will continue in the Americas, to be carried out particularly by Beijing’s swap moves.

Another attempt by China was revealed with Chinese President Xi Jinping’s visit to Saudi Arabia on early January 2023 when he made a pledge to buy more oil and gas form Gulf countries [9]. However, the most striking deal between the two countries was the fact that the energy trade would begin to be made by Chinese yuan for the first time[10]. It should be noted that China, which is the second largest economy in the world, pays tens of billions of dollars annually to Riyadh in exchange for oil[11].

However, it is not only China that tries to undermine the hegemony of the US dollar. Russian authorities have also been making efforts to undermine the reserve currency status of the dollar. The reason for this is that the ongoing war in Ukraine has caused Russia to be subjected to unprecedented economic pressure by the US and its allies, specifically most of the EU countries, Canada, Japan, and Australia[12]. In addition to this, the assets of wealthy businesspeople of Russia and the Russian banks have mostly been frozen[13]. Thus, US banks were prevented from doing business with Russia related firms with the exception of energy payments[14]. Another important sanction for Russia for the retaliation of its war against Ukraine concerns the SWIFT payment system. Russian banks can no longer use SWIFT System to make financial transactions.

Even though Moscow has been banned from much of the business ties of the world, the country still sells energy exports to the world[15]. As a matter of fact, Russia has been able to mitigate the effects of heavy sanctions due to its huge energy exports[16].

Thus, Moscow has been making efforts to change its traditional trade and financial flows[17]. In fact, China and India, which are major energy partners of Russia, have increased their energy purchases and the trade between them has been taking place in national currencies[18].

In general, the Russian and Chinese attempts at de-dollarization have become more pronounced after the war in Ukraine. On the other hand, neither of the sides accept that it is possible to break the dominant status of the US dollar in international political economy. Russian officials, for example, suggest that it is not possible to establish a feasible system that will be independent of the US dollar[19]. With this regard, Andrei Denisov, the Russian Ambassador in Beijing, declared that, ““Full de-dollarization is impossible in principle, and no one is setting this goal, considering that the dollar is actually a tool, an accounting currency, means for international settlements and international payments.”[20] The real reason for this is the liquidity problem.

It is known that the US dominance is based on firstly on its armed forces and secondly on the reserve currency status of US dollar. In this sense, the reserve currency status of the dollar is the crucial power that gives the US its say in international political economy. This was suggested by Gilpin (1987) as, “Being the supplier of the world’s money had become a major source of power and independence for the United States[21]”. However, after the recent developments, the world has witnessed intense de-dollarization attempts from eastern powers, which are aimed to undermine the US dominance in international financial markets. It is, indeed, questionable to what degree this de dollarization attempts will continue. The future developments in international relations and the future moves of FED will show how this trend will continue or adopted widespread.

*Photograph: https://www.aa.com.tr/en/world/russia-accelerates-de-dollarization-move/2266461

[1] Ma Jingjing, “China, Argentina expand currency swap scale as closer economic ties boost yuan’s use in Latin America”, Global Times, January 9, 2023,https://www.globaltimes.cn/page/202301/1283483.shtml

[2] Ibid.

[3] Ibid.

[4] Ibid.

[5] Ibid.

[6] Ibid.

[7] Ibid.

[8] Ibid.

[9] John Feng, “China is trying to end America’s Petrodollar Monopoly”, Newsweek, December 12, 2022,https://www.newsweek.com/china-saudi-arabia-gulf-arab-states-gcc-opec-america-dollar-oil-gas-energy-1766419

[10] Ibid.

[11] Ibid.

[12]Rob Garver, “Russia’s Latest Move Toward De Dollarization Seen As Symbolic”, VOA, August 29, 2022,https://www.voanews.com/a/russia-s-latest-move-toward-de-dollarization-seen-as-symbolic-/6721720.html

[13] Ibid.

[14] Ibid.

[15] Ibid.

[16] Ibid.

[17] Ibid.

[18] Ibid.

[19] Rob Garver, “Russia’s Latest Move Toward De Dollarization Seen As Symbolic”, VOA, August 29, 2022,https://www.voanews.com/a/russia-s-latest-move-toward-de-dollarization-seen-as-symbolic-/6721720.html

[20] Ibid.

[21] Robert Gilpin, The Political Economy of International Relation (New Jersey: Princeton University Press, 1987), 136.

© 2009-2025 Avrasya İncelemeleri Merkezi (AVİM) Tüm Hakları Saklıdır

Henüz Yorum Yapılmamış.

-

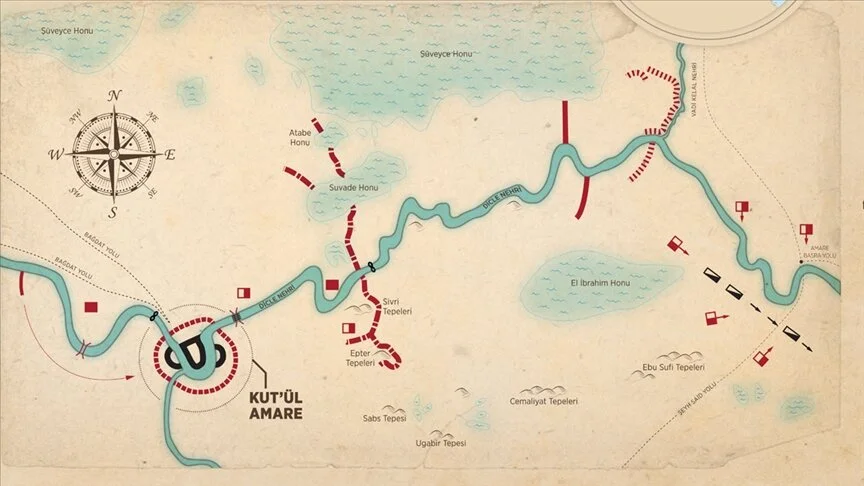

KUT'ÜL AMARE ZAFERİ - 26.05.2023

KUT'ÜL AMARE ZAFERİ - 26.05.2023

Deniz ÜNVER 26.05.2023 -

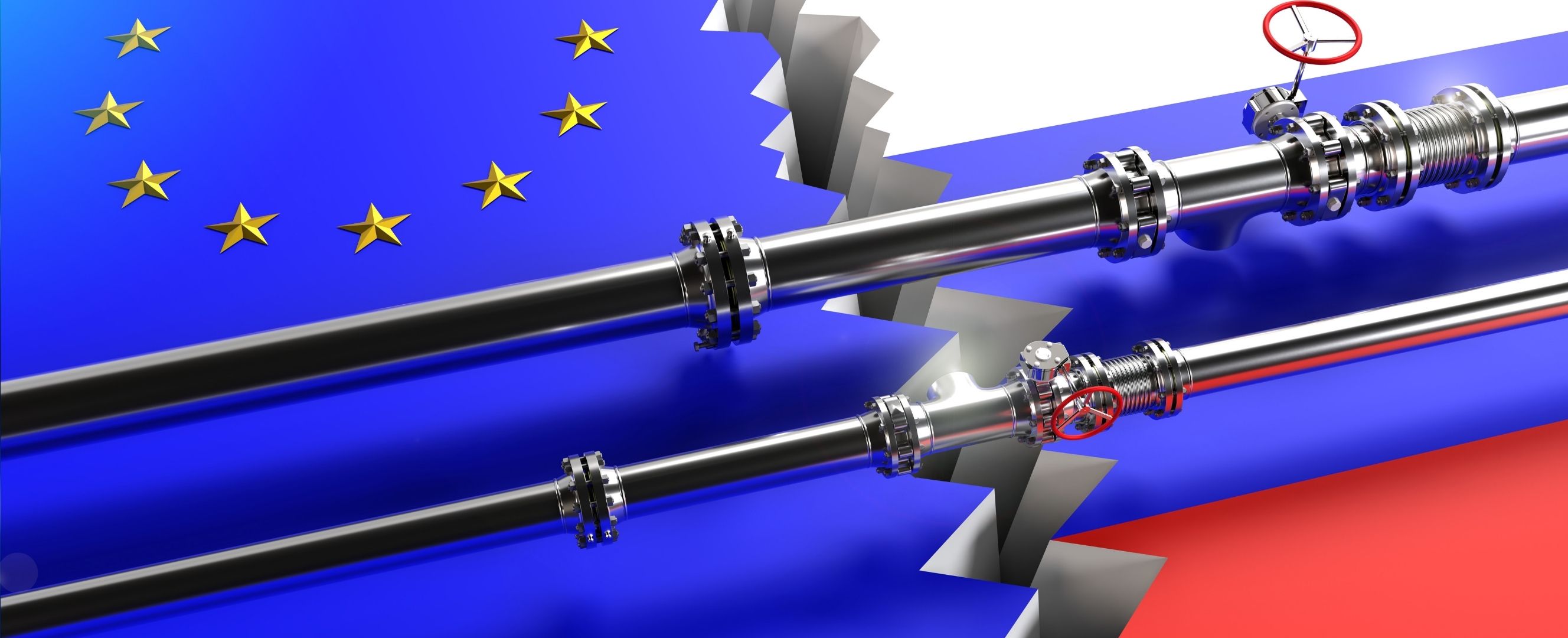

AVRUPA'DA ENERJİ KRİZİ VE TÜRKMEN GAZI: SORUN MU, ÇÖZÜM MÜ? - 09.01.2023

AVRUPA'DA ENERJİ KRİZİ VE TÜRKMEN GAZI: SORUN MU, ÇÖZÜM MÜ? - 09.01.2023

Deniz ÜNVER 09.01.2023 -

MULTILATERALISM REVISITED: TURKEY AND ITS TERM PRESIDENCY IN MIKTA - 05.04.2022

MULTILATERALISM REVISITED: TURKEY AND ITS TERM PRESIDENCY IN MIKTA - 05.04.2022

Deniz ÜNVER 06.04.2022 -

HUMAN RIGHTS VIOLATIONS OF THE REFUGEES: THE CASE OF FRONTEX AND THE EU - 14.09.2021

HUMAN RIGHTS VIOLATIONS OF THE REFUGEES: THE CASE OF FRONTEX AND THE EU - 14.09.2021

Deniz ÜNVER 14.09.2021 -

CHINA IN CENTRAL ASIA - 02.05.2023

CHINA IN CENTRAL ASIA - 02.05.2023

Deniz ÜNVER 02.05.2023

-

ÖZDAĞ'DAN TANER AKÇAM AÇIKLAMASI - YENİÇAĞ - 09.01.2018

ÖZDAĞ'DAN TANER AKÇAM AÇIKLAMASI - YENİÇAĞ - 09.01.2018

Ümit ÖZDAĞ 10.01.2018 -

TÜRKİYE-ERMENİSTAN: ÇÖZÜM BEKLEYEN KOMŞULUK

Oya EREN 21.12.2009 -

İKİNCİ KARABAĞ SAVAŞI AÇISINDAN YANLIŞ YORUMLANAN SAVAŞ ESİRİ STATÜSÜ - INDEPENDENT - 11.12.2021

İKİNCİ KARABAĞ SAVAŞI AÇISINDAN YANLIŞ YORUMLANAN SAVAŞ ESİRİ STATÜSÜ - INDEPENDENT - 11.12.2021

Memmed İSMAYILOV 14.12.2021 -

THE THREE SEAS INITIATIVE, ENERGY SECURITY AND THE STABILITY OF THE BLACK SEA REGION

THE THREE SEAS INITIATIVE, ENERGY SECURITY AND THE STABILITY OF THE BLACK SEA REGION

Teoman Ertuğrul TULUN 22.12.2023 -

AB’NİN BALKANLAR SINAVI (PELJESAC KÖPRÜSÜ) - 08.03.2021

AB’NİN BALKANLAR SINAVI (PELJESAC KÖPRÜSÜ) - 08.03.2021

Hasan Sevilir AŞAN 08.03.2021